Hard Money Georgia Things To Know Before You Get This

Wiki Article

The Buzz on Hard Money Georgia

Table of Contents6 Easy Facts About Hard Money Georgia ShownSee This Report on Hard Money GeorgiaSome Ideas on Hard Money Georgia You Need To KnowOur Hard Money Georgia Diaries

As you can see, private cash fundings are very flexible. However, it could be said that exclusive finances can put both the lender and borrower in a sticky scenario. hard money georgia. Claim the two parties are brand-new to actual estate investment. They may not recognize much, but they are close to each various other so want to aid one an additional out.

Regardless of them needing to satisfy particular requirements, private borrowing is not as managed as hard cash financings (in some situations, it's not managed at all).- Experienced investors recognize the benefits of matching their personal cash sources with a tough money loan provider.

What Does Hard Money Georgia Do?

Over all, they're accredited to provide to actual estate financiers. Perhaps a minor con with a tough money lender connects to one of the qualities that connects exclusive as well as tough cash loans policy.Nonetheless, depending on just how you consider it, this is also a toughness. It's what makes difficult money lending institutions the safer choice of the 2 for a very first time financier and also the factor that savvy financiers proceed to go down this path. WE LEND USES A VARIETY OF PROGRAMS TO SUIT EVERY KIND OF RESIDENTIAL REAL ESTATE CAPITALIST.

Not known Facts About Hard Money Georgia

It's typically possible to obtain these types of fundings from private lending institutions that don't have the same needs as typical lenders, these exclusive financings can be more costly and also less advantageous for consumers, since the threat is a lot greater. Typical loan providers will take a complete take a look at your entire monetary scenario, including your earnings, the amount of financial obligation you owe other loan providers, your credit rating, your other properties (consisting of cash money gets) as well as the dimension of your deposit.

Hard cash loans have lots of benefits over service fundings from financial institutions and also other mainstream loan providers. Are hard cash loans worth it? Under the best scenarios absolutely.Fast financing can be the difference in the success or failing of a chance. Tough cash lending institutions can transform a lending application right into available cash money in a matter of days. Do difficult money lenders inspect credit rating? Yes, but they focus on security most of all else. They do not review a customer's credit value similarly as even more regulated sources of funds. Lower credit report and some unfavorable marks in consumers'economic backgrounds play a smaller sized function in the loan provider's approval choice. In situation of default, the lending institution needs to be ensured that the profits from sale of the residential property will certainly suffice to redeem the lending's unpaid principal balance. Somewhat, also the consumer's ability to pay back the lending during the term is lesser than various other choosing elements. The lending institution should make sure the consumer can make the called for settlements. Fewer state and also federal regulations regulate tough money lending institutions, which permits this adaptability. But, because of the Dodd-Frank Act, difficult cash loan providers generally do not lend for the acquisition of a primary home. Hard cash lendings are a sort of alternate funding

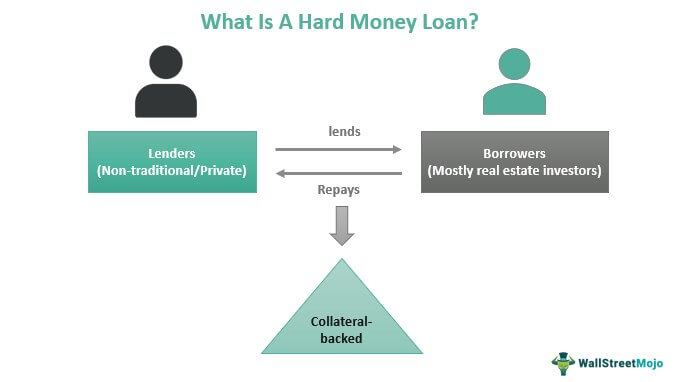

that can be used genuine estate investment chances. Unlike traditional car loans, which are issued by banks or other economic institutions and are based mostly on the borrower's creditworthiness and income, difficult cash car loans are provided by personal investors or companies and are based largely on the worth of the home being made use of as collateral. It offers the debtor an alternative to the typical home loan programs or traditional lenders. The most common use these finances are with solution & turns and also short term financing demands. The difficult money loans that we provide are elevated via tiny individual investors, hedge funds, see as well as various other personal organizations. Because of the risk taken by the car loan suppliers, passion prices are generally greater than the ordinary mortgage. Our items have shorter terms and also are generally for 6 months to 5 years, with interest only choices and also are not meant to be a long-term financing service. Customized Home Loan Hard Cash Loan Programs Include the complying with main program: 1-4 Unit Residential Properties including Apartments, townhouses, apartment or condo residences, and other special residential or commercial properties. This is because difficult money lending institutions are largely concentrated on the worth of the property, as opposed to the debtor's creditworthiness or earnings. Because of this, tough cash loans are commonly utilized by real estate investors who need to secure financing quickly, such as when it comes to a solution and also turn or a brief sale. This consists of single-family homes, multi-unit buildings, commercial homes, and even land.

The Facts About Hard Money Georgia Uncovered

Additionally, tough cash lendings can be used for both purchase and refinance purchases, along with for construction and renovation projects. While hard cash financings can be a valuable device for actual estate capitalists, they do include some downsides. Regardless of these downsides, tough cash lendings can be an important tool for real estate financiers. If you are considering a hard moneyloan, it's crucial to do your research study as well as discover a respectable lender with competitive prices and terms. Furthermore, it is very important to have a clear plan in area for just how you will certainly use the car loan proceeds and also exactly how you will leave the financial investment. To conclude, hard cash lendings are a kind of alternate financing that can be utilized for genuine estate investment opportunities. They are released by exclusive capitalists or firms and also are based largely on the value of the home being utilized as collateral. Among the primary advantages of hard cash financings is that they can be acquired rapidly as well as easily, frequently in as low as a couple of days. Hard click for more cash loans typically have greater rate of interest rates and also charges than standard loans, as well as have much shorter terms. Consumers should very carefully consider their alternatives and also have a clear plan in place before dedicating to a difficult cash loan. These lendings are suitable for individuals that are credit scores damaged. This is because, as long as you have excellent security, the tough lending lenders will use you a financing even if you are bankrupt. The financings are likewise ideal for the foreign nationals who will not be provided financings in other organizations given that they are non-citizens of a provided nation. One great benefit is that the fundings are easier to gain access to; consequently, if you do not fulfillthe certifications of the traditional lending institution, you can easily access the loan without going through rigorous documentation. These lending institutions use investor lendings alongside the rate as well as benefit benefits that tough money provides, yet with more dependable closings and far better transparency and also solution through the procedure. Personal lenders generally have a lot more capital to release and extra reputable access to resources than hard cash loan providers. These are 2 substantial reasons that financiers considering difficult cash should Click Here explore personal lenders and also especially.( Last Updated On: June 1, 2022)There are lots of funding alternatives for actual estate financiers available today. One of one of the most popular choices has actually become the difficult cash loan. A difficult cash funding is a funding collateralized by a tough possession (most of the times this would be actual estate).Report this wiki page